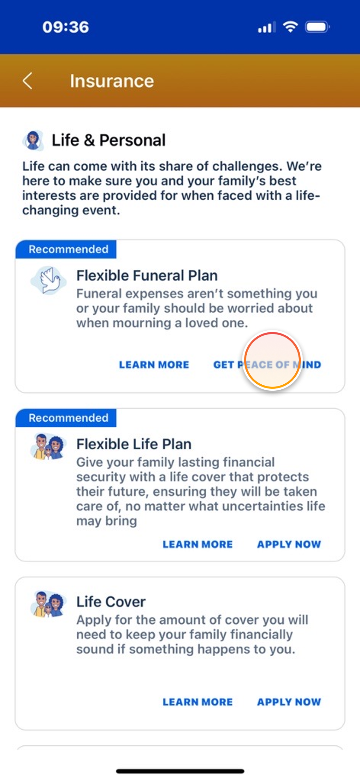

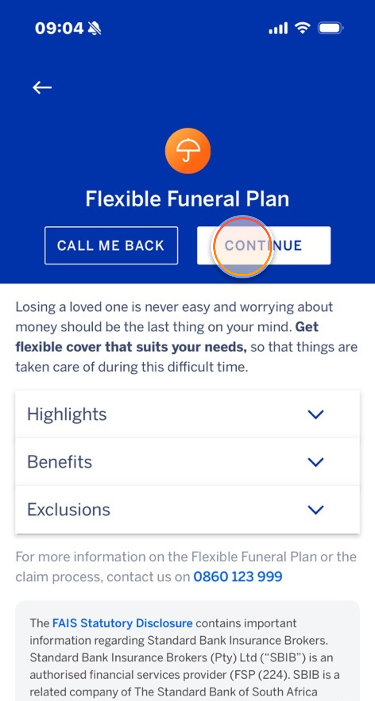

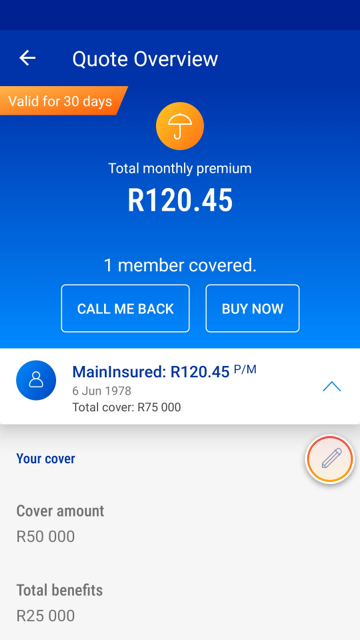

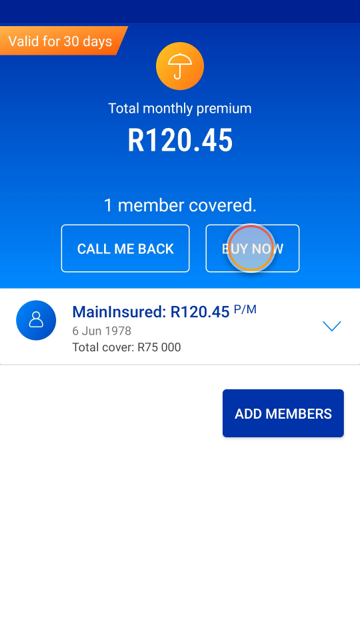

Get a Flexible Funeral Plan quote

Tailor your funeral plan cover to meet your needs, when faced with a life-changing event.

Frequently asked questions about the Flexible Funeral Plan

-

How does it work

-

Who will be covered

-

Making payments

Your cover will start once you’ve paid your first monthly premium.

Yes, the documents will be sent to you via SMS and/or email as soon as you have concluded the purchase of your policy.

Yes, the policy will cover all insured lives if they were to pass away due to an accident as long as the first premium was paid. In the event of an accident, we will pay you up to the maximum of R100 000 for the double accident benefit.

- A 6-month waiting period for all policy members in the event of a natural death

- A 6-month waiting period to claim for the grocery, catering and memorial benefit (if you have added these additional benefits to your funeral cover)

- A12-month waiting period for death by suicide.

No benefits will be paid during the waiting period. If any member passes due to natural causes during the waiting period, we’ll refund the premiums paid for that particular member. The waiting period won’t apply if any member passes due to an accident.

This policy allows you to select and pay an additional premium for:

- Catering benefit (applicable to main insured and spouse only)

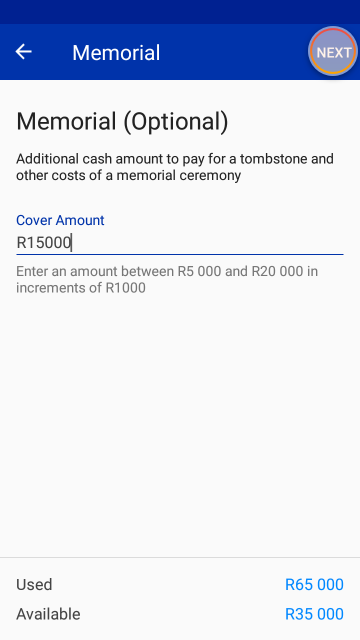

- Memorial benefit (applicable to main insured and spouse only)

- Grocery benefit (applicable to main insured and spouse only)

- Airtime benefit (applicable to all lives) • Repatriation benefit (applicable to all lives)

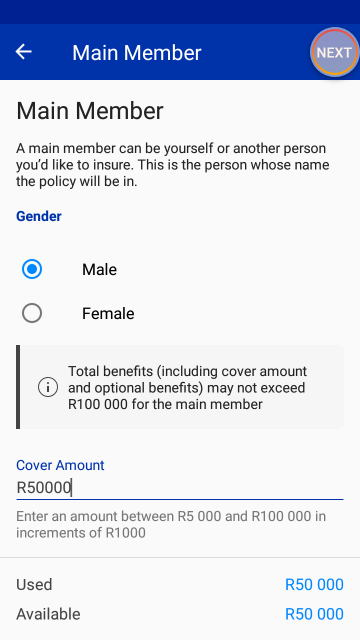

Policyholder

- Minimum sum assured: R5 000

- Maximum sum assured: R100 000

Spouse

- Minimum sum assured: R5 000

- Maximum sum assured: R100 000

Children

- Minimum sum assured: R5 000

- Maximum sum assured:

- Stillborn - 3 months: R5 000

- 3 months - 5 years: R20 000

- 6 years - 13 years: R50 000

- 14 years and older: R50 000

Parents

- Minimum sum assured: R5 000

- Maximum sum assured: R80 000

Extended Family

- Minimum sum assured: R5 000

- Maximum sum assured: R50 000

The policyholder (also referred to as the main member) and other life assureds can also be insured. These can include:

- his/her spouse and up to 6 children,

- up to 8 extended family members, and

- up to 4 parents and parents-in-law under this policy

Yes, your child will be covered until the age of 25 on the condition that they are still attending school and fully dependent on the policyholder (parents/guardian).

Yes, you can, but you will need all the legal documents stating that you’re the children’s legal guardian.

You can also cover your grandchildren under extended family members on the policy.

Your extended family includes the policyholder's parent or parent-in-law, child, nephew or niece, uncle or aunt, cousin, grandparent, grandchild, brother or brother-in-law, and sister or sister-in-law.

- Cousin: the child of the policyholder's uncle/aunt

- Grandchild: the child of the policyholder's son or daughter

- Grandparent: the mother or father of the policyholder's or spouse's parent

- Nephew/niece: the son/daughter of the policyholder's or spouse's brother or sister

- Uncle/aunt: the brother/sister of the policyholder's mother or father

Dependents are persons who rely on another, especially a family member, for financial support.

You are covered for the remainder of your life provided that the policy is active and that your premiums are up to date. The policy has a maximum entry age:

- Main insured and spouse: 18 - 65

- Children: 0 - 25

- Extended family members: 0 - 84

- Parents/parents-in-law: 18 – 84

The money will be paid out on a valid claim to yourself or your nominated beneficiary as soon as all documents have been received, and policy conditions have been met.

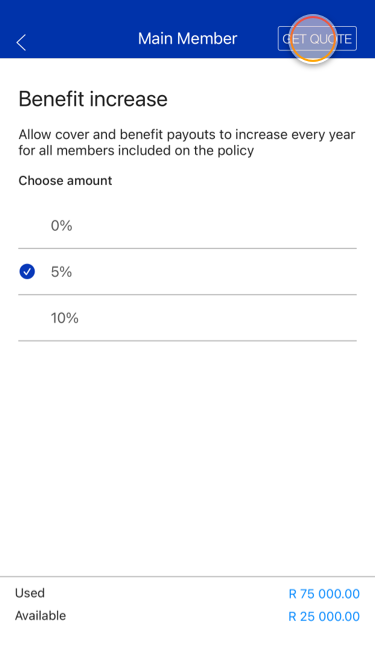

Only if you have selected the automatic benefit increase.

Any automatic benefit increases selected will result in the benefit amount increasing at each policy anniversary.

These increases will be accompanied by a related automatic premium increase to allow for the cost of the increase in benefit amount. All benefits are increased by the same benefit increase percentage.

No, there is no once-off or policyholder fee.

Yes, your premium will change annually as your age changes, and if you chose an automatic annual/benefit increase. As the life assured will be one year older at that time, you may expect that the premium payable will increase.

Should you choose to increase the sum assured at the policy anniversary, there will be an additional premium payable for the additional cover, however, Standard Bank Insurance Brokers will inform you of the changes to your policy 31 days before the changes are activated.

Upon receipt of your annual renewal letter, you should review the changes that are expected to be enforced to your policy.

If you’re unhappy with the adjustments to your policy, please contact Standard Bank Insurance Brokers to discuss different options to suit your needs.

No, that won’t be possible as the premiums are collected monthly i.e. this is a month-to-month policy.

The premium is payable monthly in advance. If there are insufficient funds in the account, we may track your account using a PASA approved system and re-send the instruction for payment as soon as sufficient funds are available in the account.

Your policy will not lapse if you are unable to pay a premium. However, if you skip a premium, the value of the policy benefit will be reduced proportionately.